Ever wondered what hyperinflation really looks like? You may have heard about it in Germany, Venezuela or Zimbabwe, but many have never seen what it actually entails.

In January 2022, we traveled to Lebanon and left with our observations of hyperinflation in the modern era. The country’s economic situation has drastically changed from the last time we were there in 2019.

Read more to find out the causes and effects of the sinking value of the Lebanese Lira (LBP) and how the hell people are managing on the daily.

Hypertension or hyperinflation?

As I write this, I am overlooking Sassine Square in the Beirut neighborhood of Achrafieh. The sugarcoated, sweet cheese sandwich known as knefe is exactly what I need to keep me alert and attentive. For a traditional Lebanese lunch can render you full of hommos, baba ghanoush and mixed grill – essentially useless.

It’s pouring rain outside when I notice a grouping of umbrellas across the street. A car pulls up and out comes a small coffin.

Suddenly the sound of Lebanese drums permeates the air and the coffin, held by two protestors, starts jumping up and down in the air. People in the café stop what they are doing to watch as the demonstration blocks the busy street and stops traffic entirely.

Today there is a public transport protest – one of all the sectors hit by hyperinflation, where people are earning not even a quarter of what they used to make before.

From 1,500 LBP to 35,000 LBP for 1 USD

The World Bank describes Lebanon’s crisis as one of the worst depressions in world history. As I pay an eyewatering 50,000 LBP for my knefe, I ask myself: just how did we get here?

In short, the Lebanese economy is in deep shit. Government debt is 500% of the gross domestic product – in short, it hasn’t been this bad since the 1975 civil war which plagued the country for 15 years.

While the official exchange rate is 1,500 Lira for 1 US Dollar (USD), the real value has seen increases as high as 35,000 LBP for 1 USD. It bounces daily between 19,000 and 30,000 LBP.

A series of unfortunate events

When I left Lebanon in September 2019, a few key events took place.

A liquidity crisis became apparent in Lebanon when Lebanese expatriates started sending less and less money back to Lebanon. The Central Bank of Lebanon, known also as Banque du Liban (BDL), saw its USD reserves being depleted.

As a result, the BDL began printing more Lebanese lira and the supply of lira increased 266% from December 2019 to December 2021. This is when the black-market rate of the lira started falling against the dollar. Our Lebanese financial guru Ali Ramadan explains why:

“The reason behind why the government was printing money was that it was no longer able to hold the 1,500 LBP to 1 USD peg (a fixed exchange rate set by a government). The peg is like a seesaw, if you have too many people selling LBP/buying USD or vice versa, you’re basically putting too much weight on one side of the seesaw – messing up the peg.”

The BDL was maintaining the system with the many Lebanese expatriates sending USD to Lebanon where it would be exchanged to Lira. That was fine until, according to Ramadan:

“Money stopped flowing in from expatriates (it still flowed in, but at a much lower rate) and it eventually got hard for the BDL to keep this peg. They weren’t getting as much USD anymore to fix the peg. Hence why they started printing money”.

Other factors

In March 2020 COVID-19 shut down the country, the region and the world, making life much more difficult for the average person. People in Lebanon were locked down for months.

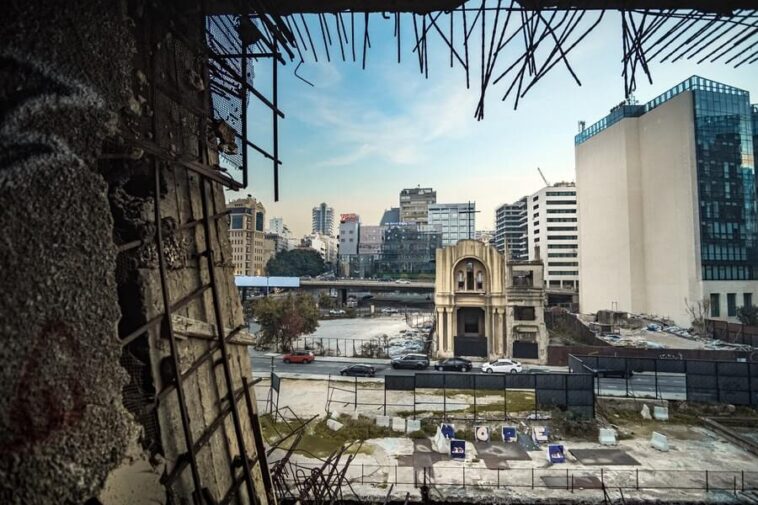

Then the unthinkable happened in August 2020. A warehouse full of poorly stored ammonium nitrate exploded in a case that was described as extreme negligence. The fallout was severe, including a the port and multiple neighborhoods being destroyed. The blast broke windows as far as 10km away. Once the dust settled, over 200 people were killed, 7,000 were injured and over a quarter of million citizens were left homeless.

Granted, there are many other catalysts leading up to Lebanon’s hyperinflation. Rampant corruption at the highest levels, a fundamentally fractured governmental system and additional stress from regional conflicts. While all this was happening, the Lebanese Lira began to slip, the cost of even the most basic needs became unthinkably high.

Hyperinflation: Lebanese cash turned monopoly money

Lebanon is running completely on a cash economy. When you exchange money, a rubberband is used to keep your cash together. Establishments are only accepting cash payments. More and more people walk around with what looks like a small bag or trousse – because there is always a stylish way to carry around your money, regardless of it’s worth.

Sure, you can use your card, if they accept it. However, it must be an account in Lebanese pounds or it will be charged at the official rate of 1,500 LBP per 1 USD. Ultimately using a card is not a good idea as the black-market rate (and currently used rate everywhere) fluctuates between 20-30,000 LBP per 1 US dollar, and nobody wants to pay 40 USD for a coffee.

Imagine walking into a grocery store and not knowing the price of the goods you are about to buy; that’s the current state of Lebanon. The exchange rate changes daily, so how can anyone with a business keep up? It’s difficult when you must pick and choose what products to buy in order not to spend your heavily depreciated salary away.

“We’re dependent on imports for a lot of things.” Says Ali. “Lebanon literally doesn’t produce anything, so the cost of importing food/goods shot up (due to breaking the peg) and as a result prices of things in Lebanon has gone up to match this increase in costs.”

Daily purchases

I enter a store to buy Al-Rifai. They sell assorted nuts, a typical Lebanese snack. However, I only have USD left and won’t be in the country long enough to exchange more. No worries – a call is made to the manager to confirm the exchange rate and I am given a stack of LBP back for my meagre 20 USD bill. It’s disheartening.

Another example – I go to get my haircut and end up paying the equivalent of 1 USD. One dollar, people. I end up going back a few times, happy to pay and over tip this professional for his work in his parlor which most of the time is without electricity.

All in all, the Lebanese economy is rapidly shrinking and people want out.

(Another) Lebanese exodus

In my opinion, the most catastrophic effect of the hyperinflation is the massive brain drain.

This is when the brightest and most intelligent students and professionals leave the country to make a better living elsewhere. Not to say this wasn’t the case before the currency crisis began in 2019 – it’s only that emigration has been accelerated at an alarming rate. Everyone we speak to has thoughts or plans of leaving or sending their kids away.

Lebanese people who stored a lot in their banks have taken huge losses – enough for them to decide to leave the country completely.

In essence, the middle class is shrinking and there are many more people living below the poverty line now.

How people are managing hyperinflation

In all honesty, we are not sure.

I reach out to my friend Raffoul from my university days to comment. “At first I was getting paid only a part of salary in dollars and the rest in LBP. The result was that I was suffering the devaluation of the Lira. However, currently I am being paid in fresh USD so my problems are resolved.”

If someone’s salary is in foreign currency, they might be doing ok. Let’s say someone working for a foreign company or an organization like the UN. If your salary is in Lebanese Lira, then life is really difficult. Your salary has depreciated by 90% and you simply can’t afford to spend like before.

There are a few factors that are keeping the country together and that’s a large diaspora that sends money back to their family in Lebanon. During the civil war an enormous amount of people left, so it only makes sense that this system of currency coming from outside can keep the country afloat. But some are not so lucky.

An organization making a difference

To find out what is being done to help those most in need, I take a cab over to the Beirut Digital District. There I sit down with Yasmina of Live Love, a non-governmental organization in Lebanon whose original purpose was to show the beauty of Lebanon while promoting an environmental cause.

After the Beirut bomb of August 4, 2020 it has become an NGO coordination and management center. They also have opened a help line for people that have been detrimentally affected by the hyperinflation.

The objective is to develop initiatives to aid those who cannot afford to eat every day. Due to the increasing numbers of people applying for aid, a sort of triage must be made to help those that are very vulnerable.

“We have to do a vulnerability assessment to decide who needs help the most. We are currently piloting an e-voucher program that will allow recipients to use their vouchers in local stores, putting money back into the economy.”

“It is less wasteful than material charity and is absolutely traceable, which is a plus for donors.”

Live Love has many social media pages that show the beauty of the country. Their main audience is Lebanese expatriates, many of whom are happy to send money back. For such a beautiful country, we only hope they will rebound to better times.